Unlock the potential of making money online through cryptocurrency trading. Explore the strategies and opportunities that can help you navigate this dynamic market and achieve financial gains from the comfort of your own home.

“Embrace the Digital Frontier: Earn Money Online with Cryptocurrency Trading!”

Introduction

The world of cryptocurrencies has gained immense popularity over the years, with Bitcoin leading the way.

Alongside the growth of digital currencies, online trading has become an increasingly popular method of making money.

This comprehensive guide will walk you through the steps and strategies to make money online through cryptocurrency trading.

IMPORTANT! .. It’s your money. Please understand it thoroughly before starting.

Understanding Cryptocurrency Trading

Cryptocurrency trading involves buying and selling digital currencies on various cryptocurrency exchanges. It can be done in different ways, .. including ..

- spot trading,

- futures trading,

- margin trading,

- and more.

To get started, you need to familiarize yourself with cryptocurrency exchanges and wallets. Exchanges are online platforms where you can trade cryptocurrencies, while wallets are used to store your digital assets securely.

REMEMBER! .. It’s crucial to understand the factors that influence cryptocurrency prices, .. such as market demand, regulatory developments, news events, and overall market sentiment.

Mindset and Psychology in Cryptocurrency Trading

Developing the right mindset and psychology is crucial for successful cryptocurrency trading. Here are things that you might condider:

1. Patience and Discipline

Be patient and disciplined in your approach to trading. Avoid impulsive decisions driven by fear or greed.

Stick to your trading plan and strategies, even during periods of market volatility.

2. Risk Management

Understand and accept the risks associated with cryptocurrency trading. Set realistic expectations and manage risk through proper position sizing, stop-loss orders, and diversification.

We want to mention .. Be prepared for potential losses and avoid risking more than you can afford to lose.

3. Emotional Control

Keep emotions in check when making trading decisions. Fear and greed can lead to irrational choices.

It’s important skill! .. Develop emotional resilience and avoid making impulsive trades based on short-term market fluctuations or news events.

4. Long-Term Perspective

Adopt a long-term perspective when approaching cryptocurrency trading.

Cryptocurrency markets can be highly volatile, and short-term price fluctuations may not accurately reflect the long-term potential of a cryptocurrency.

Keep in mind .. avoid being overly influenced by daily price movements.

5. Continuous Learning

Stay curious and committed to learning about cryptocurrencies, blockchain technology, and market trends.

Don’t Forget! .. The cryptocurrency information has been changing very fast, not day or month, but minute.

Keep up with news, research, and educational resources related to cryptocurrencies. Adapt and evolve your trading strategies based on new information.

6. Detachment from Outcomes

Detach yourself from the outcomes of individual trades. Understand that losses are a natural part of trading and not every trade will be profitable.

We advise .. Focus on the overall performance of your portfolio and the long-term results.

7. Analytical Approach

Use a data-driven and analytical approach to decision-making. Base your trading decisions on thorough research, technical analysis, and fundamental analysis.

We want to mention! .. Avoid relying solely on speculation or market rumors.

8. Adaptability

Be adaptable to changing market conditions. Cryptocurrency markets can be highly volatile and unpredictable. So .. be prepared to adjust your strategies, exit positions when necessary, and capitalize on new opportunities.

9. Managing Information Overload

Cryptocurrency markets are fast-paced, and information flows constantly. Learn to manage information overload and filter out noise.

You should be aware that .. focus on reliable sources of information and avoid being swayed by sensationalized news or market hype.

10. Maintain a Balanced Perspective

Keep a balanced perspective on your trading activities. Remember that cryptocurrency trading is just one aspect of your life.

You might consider this .. Take breaks, maintain a healthy work-life balance, and avoid becoming overly obsessed or stressed about trading outcomes.

To recap .. by cultivating the right mindset and psychology, you can approach cryptocurrency trading with a rational and disciplined approach, .. increasing your chances of making informed decisions and achieving long-term success.

Money Management for Cryptocurrency Trading

Proper money management is crucial for successful cryptocurrency trading. Below are some suggestions:

1. Set a Budget

IMPORTANT! .. Use only money that you can afford to lose.

Determine how much money you can afford to invest in cryptocurrencies without impacting your financial stability or meeting essential expenses.

This amount should be considered as discretionary or risk capital.

2. Diversify Your Investments

Bear in mind .. Don’t put all your eggs in one basket.

Avoid putting all your funds into a single cryptocurrency. Diversify your portfolio by investing in multiple cryptocurrencies to spread the risk.

This way, if one investment performs poorly, it may be offset by others that perform well.

3. Determine Risk Tolerance

Assess your risk tolerance based on your financial goals, investment horizon, and personal comfort level.

Determine what level of risk you are willing to accept and adjust your trading strategies accordingly.

4. Use Stop Loss Orders

This is one of the key trading strategies. Implement stop loss orders to automatically sell a cryptocurrency if its price reaches a specific predetermined level.

This helps limit potential losses and protect your investment from significant downturns.

5. Set Profit Targets

Establish profit targets for your trades. When a cryptocurrency reaches your desired profit level, consider selling a portion or all of your position to lock in gains.

It’s important to be disciplined and not let greed drive your decision-making.

6. Regularly Review and Adjust

Continually review your portfolio and trading strategies. Stay updated with market trends, news, and events that may impact the cryptocurrency market.

Be prepared to adjust your portfolio and strategies accordingly.

7. Use Proper Position Sizing

Determine the appropriate position size for each trade based on your risk tolerance and the potential reward-to-risk ratio of the trade.

Important! .. Avoid risking a significant portion of your capital on a single trade.

8. Keep Emotions in Check

Emotional decision-making can lead to poor choices. Avoid making impulsive trades based on fear, greed, or the fear of missing out (FOMO).

Note: .. Stick to your trading plan and strategy.

9. Maintain Adequate Liquidity

Ensure you have sufficient funds available for unexpected market opportunities or emergencies. Avoid tying up all your capital in illiquid cryptocurrencies.

10. Consider Using Risk Management Tools

Explore risk management tools like trailing stops, take-profit orders, and hedging strategies to manage risk and protect your capital.

One thing to remember! .. there is no guaranteed strategy for cryptocurrency trading success, and the market can be highly volatile. It’s essential to educate yourself, stay informed, and make informed decisions based on your risk tolerance and financial goals.

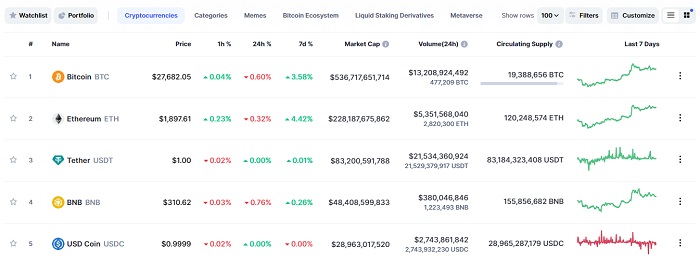

Top 20 Cryptocurrencies

Here are the top 20 cryptocurrencies based on market capitalization as of May 31, 2023, sourced from https://coinmarketcap.com:

- Bitcoin (BTC)

- Ethereum (ETH)

- Tether (USDT)

- BNB (BNB)

- USD Coin (USDC)

- XRP (XRP)

- Cardano (ADA)

- Dogecoin (DOGE)

- Solana (SOL)

- Polygon (MATIC)

- TRON (TRX)

- Litecoin (LTC)

- Polkadot (DOT)

- Binance USD (BUSD)

- Shiba Inu (SHIB)

- Avalanche (AVAX)

- Dai (DAI)

- Wrapped Bitcoin (WBTC)

- Chainlink (LINK)

- UNUS SED LEO (LEO)

NOTE: .. Let’s keep in mind that the cryptocurrency rankings can change frequently, and it’s always advisable to refer to a reliable and up-to-date source like CoinMarketCap for the most current information.

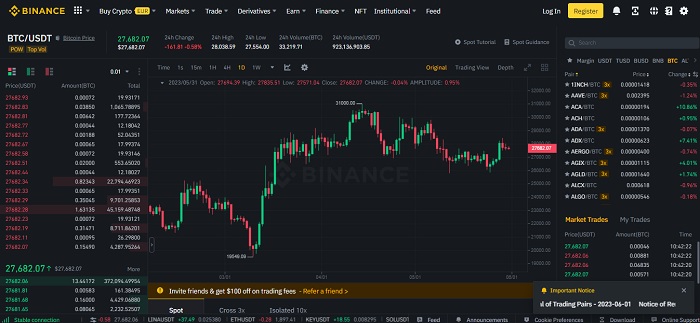

Top Cryptocurrency Spot Exchanges

The list below are based on CoinMarketCap website.

The CoinMarketCap ranks and scores exchanges based on traffic, liquidity, trading volumes, and confidence in the legitimacy of trading volumes reported.

- Binance

- Coinbase Exchange

- Kraken

- KuCoin

- Bybit

- Bitstamp

- OKX

- Bitfinex

- Gate.io

- Gemini

NOTE: .. The data is as of May 31, 2023, sourced from the CoinMarketCap website.

We recommended to verify the latest and most accurate information by visiting the CoinMarketCap website directly.

Common Cryptocurrency Trading Terminology

Here are some common terminology used in cryptocurrency trading:

- Cryptocurrency: A digital or virtual currency that uses cryptography for security and operates independently of a central bank.

- Altcoin: Any cryptocurrency other than Bitcoin. Altcoin stands for “alternative coin.”

- Blockchain: A decentralized digital ledger that records all cryptocurrency transactions across multiple computers or nodes.

- Wallet: A digital storage facility that holds a user’s cryptocurrency securely. It can be a software wallet (an application) or a hardware wallet (a physical device).

- Exchange: An online platform where users can buy, sell, and trade cryptocurrencies.

- Market Order: An instruction to buy or sell a cryptocurrency at the best available price in the market.

- Limit Order: An instruction to buy or sell a cryptocurrency at a specific price or better.

- Bid: The highest price a buyer is willing to pay for a cryptocurrency.

- Ask: The lowest price a seller is willing to accept for a cryptocurrency.

- Spread: The difference between the highest bid price and the lowest ask price for a cryptocurrency.

- Volume: The total amount of a cryptocurrency traded within a specified period, usually measured in terms of the base currency.

- Liquidity: The ease with which a cryptocurrency can be bought or sold without causing significant price movement.

- Bull Market: A market characterized by rising prices and optimistic investor sentiment.

- Bear Market: A market characterized by falling prices and pessimistic investor sentiment.

- FOMO (Fear of Missing Out): The fear of missing out on potential profits, which may lead to impulsive buying decisions.

- FUD (Fear, Uncertainty, and Doubt): Negative information or rumors spread to create panic or uncertainty in the market.

- HODL: A term originating from a misspelling of “hold,” indicating a long-term investment strategy without selling during market downturns.

- Pump and Dump: A manipulative scheme where a group artificially inflates the price of a cryptocurrency and then sells it at a profit, causing a sharp price decline.

- Whale: An individual or entity that holds a large amount of cryptocurrency and can influence market prices with their trading decisions.

- ATH (All-Time High): The highest price ever reached by a particular cryptocurrency.

NOTE: .. We suggest that you should familiarize yourself with these terms to better understand discussions and analysis related to cryptocurrency trading.

Getting Started with Cryptocurrency Trading

Setting up an Account

To begin trading cryptocurrencies, you’ll need to choose a reliable cryptocurrency exchange. Look for exchanges that have ..

- a good reputation

- strong security measures,

- and a wide selection of cryptocurrencies.

NOTE: .. Based on CoinMarketCap website, the #1 exchange is Binance (as of May 31, 2023). You can also consider the top cryptocurrency exchanges in your country

Once you’ve chosen an exchange, create an account and complete the verification process. This typically involves providing identification documents and proof of address.

Additionally, .. we recommend you should enable two-factor authentication (2FA) to add an extra layer of security to your account.

Research and Education

Before diving into cryptocurrency trading, it’s essential to educate yourself about the market. Start by understanding the fundamentals and technical analysis of cryptocurrencies.

- Fundamental analysis involves assessing the underlying technology, team, partnerships, and overall market demand.

- Technical analysis, on the other hand, focuses on studying price patterns, chart indicators, and other market data.

Stay informed by following reputable news sources and market trends.

One option is .. you can also learn from successful traders and industry experts through books, online courses, or trading communities.

Developing a Trading Strategy

1. Setting Goals and Risk Tolerance

Define your financial goals and investment horizon. Are you looking for short-term gains or long-term investments?

Assess your risk appetite and determine how much you’re willing to risk in each trade. It’s crucial to strike a balance between potential profits and acceptable risk levels.

2. Choosing the Right Cryptocurrencies

Research and analyze different cryptocurrencies before making investment decisions. Look for projects with strong fundamentals, a dedicated team, and potential for growth.

Consider factors, such as:

- market liquidity

- community support

- and the technology behind the cryptocurrency.

NOTE: .. Diversify your portfolio to mitigate risk and avoid putting all your eggs in one basket.

3. Technical Analysis

Technical analysis plays a significant role in identifying potential entry and exit points for trades. Please invest yourself in the knowledge.

Learn about different chart patterns, indicators, and candlestick charts to analyze price movements.

Utilize technical analysis tools to assist in your decision-making process. Some common strategies include trend following, breakout trading, and swing trading.

4. Fundamental Analysis

In addition to technical analysis, keep an eye on fundamental factors that can impact the market. Assess the underlying technology, team expertise, and partnerships of the cryptocurrencies you’re interested in.

IMPORTANT! .. Stay updated on regulatory developments, news events, and market sentiment. Understanding these factors will help you make informed trading decisions.

Risk Management and Security

Trading cryptocurrencies involves risks, and it’s crucial to implement risk management strategies to protect your capital.

- Set stop-loss and take-profit levels: Determine the price levels at which you’ll exit a trade to limit potential losses or secure profits.

- Implement position sizing: Decide how much of your capital you’re willing to allocate to each trade based on your risk tolerance.

- Diversify your portfolio: Spread your investments across multiple cryptocurrencies to reduce the impact of a single asset’s performance.

- Keep funds secure: Consider using hardware wallets to store your cryptocurrencies offline. If you prefer to trade on exchanges, choose reputable platforms with strong security measures.

Executing Trades

Once you have a trading strategy in place and have conducted thorough research, it’s time to execute trades.

Keep in mind that .. it’s a time for potential gains or losses. BE CAREFUL!

- Place buy and sell orders on the exchange: Specify the amount of cryptocurrency you want to buy or sell and the price you’re willing to pay or accept.

- Understand different order types: Market orders execute immediately at the current market price, while limit orders allow you to set a specific price at which your order will be executed.

- Monitor and manage your trades: Keep an eye on your open positions, adjust stop-loss and take-profit levels if needed, and stay informed about market conditions that might affect your trades.

Monitoring and Adjusting Your Strategy

Trading is an ongoing process that requires monitoring, analysis, and adjustment.

NOTE: .. Please allocate time for this activity that is suitable for your daily life.

- Regularly review and analyze your trading performance: Assess the success of your trades, identify patterns, and learn from both profitable and losing trades.

- Make adjustments based on market conditions and feedback: Adapt your strategy as the market evolves. Consider incorporating new information and refining your approach based on your trading experience.

- Keep emotions in check: Avoid making impulsive decisions driven by fear or greed. Stick to your trading plan and avoid chasing losses or overtrading.

Additional Ways to Make Money with Cryptocurrency

While trading is a popular method, OPTIONAL! .. there are other ways to make money with cryptocurrencies.

- Participate in initial coin offerings (ICOs) and token sales: Research and invest in promising blockchain projects during their early stages.

- Stake and earn passive income: Some cryptocurrencies offer staking rewards for holding and validating transactions on their networks.

- Explore cryptocurrency mining or running a masternode: Depending on the cryptocurrency, you may have the opportunity to earn rewards by contributing computational power or running a masternode.

Note: It is essential to have a precise understanding of the options before getting started.

Learning from Mistakes and Continuous Improvement

“Learn, improve, repeat.”

Accept that losses are a part of the learning process and focus on continuous improvement.

- Analyze past trades: Identify any mistakes or areas for improvement in your trading strategy. Learn from your experiences and adjust accordingly.

- Stay up-to-date with industry trends: Cryptocurrency markets are dynamic, and staying informed about new developments and trends will help you adapt to changing conditions.

- Adapt and evolve: Keep learning and exploring new strategies and techniques. Continuously refine your trading approach based on your experiences and feedback from the market.

Final Thoughts

Making money online with cryptocurrency trading can be both rewarding and challenging. It requires dedication, research, and continuous learning.

Start small and gradually increase your involvement as you gain experience and confidence.

Be cautious of scams and fraudulent schemes that exist in the cryptocurrency space, and always prioritize the security of your funds.

With the right knowledge, strategy, and risk management, you can take advantage of the opportunities offered by cryptocurrency trading.

NOTE: .. For more information, please check out our articles on “100 Ways to Make Money Online“.

FAQs

Q: What is cryptocurrency trading?

A: Cryptocurrency trading refers to the buying and selling of digital currencies on various online platforms. It involves speculating on the price movements of cryptocurrencies to make profits.

Q: How does cryptocurrency trading work?

A: Cryptocurrency trading typically takes place on cryptocurrency exchanges. Traders can buy cryptocurrencies using traditional currencies or other cryptocurrencies, .. and they can sell them for a profit when the prices increase.

The trades are executed through a combination of order books and trading pairs on these exchanges.

Q: What is a cryptocurrency exchange?

A: A cryptocurrency exchange is an online platform that enables users to buy, sell, and trade cryptocurrencies.

These exchanges provide a marketplace where buyers and sellers can interact and exchange digital currencies.

Q: What are some popular cryptocurrency exchanges?

A: There are several popular cryptocurrency exchanges, .. including ..

- Binance

- Coinbase

- Kraken

- Bitfinex

- and Huobi.

Each exchange offers different features, trading pairs, and user interfaces.

Q: What are trading pairs in cryptocurrency trading?

A: Trading pairs in cryptocurrency trading represent the two currencies that can be traded against each other.

For example, .. a common trading pair is BTC/USD, which means trading Bitcoin against the US dollar. Traders can take positions in either direction by buying or selling the base currency (first currency) in the pair.

Q: What is the difference between a market order and a limit order in cryptocurrency trading?

A: A market order is an instruction to buy or sell a cryptocurrency at the best available price in the market. It guarantees execution but does not guarantee the price.

On the other hand, .. a limit order is an instruction to buy or sell a cryptocurrency at a specific price or better. It offers price control but does not guarantee immediate execution.

Q: What are some common cryptocurrency trading strategies?

A: There are various trading strategies employed in cryptocurrency trading. Some common ones include ..

- day trading,

- swing trading,

- scalping,

- and long-term investing.

Each strategy involves different time frames, risk levels, and approaches to capturing profits from cryptocurrency price movements.

Q: What are some risks associated with cryptocurrency trading?

A: Cryptocurrency trading carries certain risks, including ..

- price volatility,

- liquidity risks,

- security risks (such as hacking or theft),

- regulatory risks,

- and the risk of making incorrect trading decisions.

It is important for traders to understand these risks and employ risk management techniques to protect their investments.

Q: Do I need to have technical knowledge to start cryptocurrency trading?

A: While having technical knowledge can be beneficial, it is not a requirement to start cryptocurrency trading.

However, understanding basic concepts like wallets, exchanges, and order types can be helpful.

Additionally, .. staying informed about market trends and conducting proper research can improve your trading decisions.

Q: Are there any tax implications for cryptocurrency trading?

A: Tax regulations regarding cryptocurrency trading vary by country. In many jurisdictions, cryptocurrency trading is subject to capital gains tax.

It is advisable to consult with a tax professional or research the specific regulations in your country to ensure compliance with tax obligations.

Q: What are some resources for learning more about cryptocurrency trading?

A: There are numerous resources available for learning about cryptocurrency trading. These include ..

- online courses,

- books,

- forums,

- YouTube channels,

- and blogs dedicated to cryptocurrency trading.

It’s important to rely on reputable sources and continually educate yourself about market trends and strategies.

Other “Affiliate Marketing and Make Money Online” articles:

- Pet Food Affiliate Programs: Boost Your Earnings Now

- Make Money with Top 10 Book Affiliate Programs Today

- Top 10 Best Affiliate Programs for Automotive Electronics